What TMJ Treatment is Covered by Insurance? – A Simple Guide for 2024

Table of Contents

Introduction: Temporomandibular joint (TMJ) disorders can cause serious pain and discomfort, affecting everything from how you eat to how you speak. The good news? Many treatments are available to help. The big question: What TMJ treatment is covered by insurance? Navigating insurance policies can be tricky, especially when dealing with both medical and dental coverage. In this guide, we’ll break down which TMJ treatments are typically covered by insurance and how to make sure you get the treatment you need without breaking the bank.

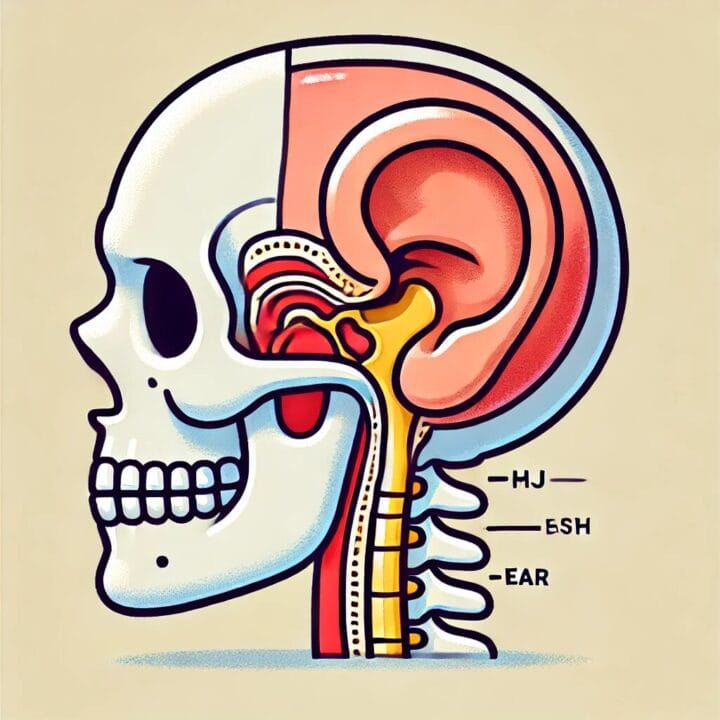

What is TMJ Treatment?

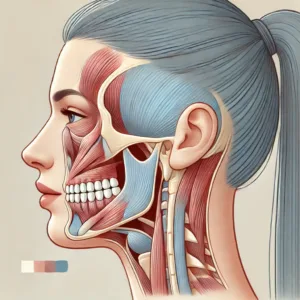

TMJ treatment involves caring for the joints that connect your jaw to your skull. When these joints don’t work properly, you may experience pain, clicking, or difficulty moving your jaw. Treatments can range from simple home remedies to more advanced procedures like surgery.

The type of treatment you need depends on your symptoms, and whether or not your insurance will cover it depends on how they classify the treatment—whether it’s considered a medical issue or a dental one.

Why is TMJ Treatment Important?

Ignoring TMJ problems can lead to chronic pain, trouble sleeping, and even anxiety. While mild cases can sometimes be managed with home care, more severe cases need professional treatment. Unfortunately, the costs of TMJ treatment can add up quickly, which is why it’s important to know what your insurance will cover.

What TMJ Treatments are Covered by Insurance?

Insurance coverage for TMJ treatment varies based on your provider and your specific plan. However, here’s a general look at what’s often covered:

1. Non-Surgical Treatments

- Physical Therapy: Many insurance plans cover physical therapy for TMJ disorders, as it’s often considered a medically necessary treatment. Exercises designed to improve jaw function and reduce pain are common forms of therapy.

- Medications: Pain relievers, muscle relaxants, and anti-inflammatory drugs are usually covered by insurance. If prescribed by your doctor, these medications are typically considered part of your medical coverage.

- Oral Appliances (Night Guards): Coverage for night guards can be a gray area. Some medical insurance plans cover them if they’re deemed medically necessary, while others classify them under dental insurance. You may need to check both your medical and dental policies.

2. Surgical and Advanced Treatments

- Injections (Botox or Steroids): Steroid injections to reduce inflammation or Botox to relax the jaw muscles may be covered, but often require prior authorization from your insurance company.

- Surgery: If conservative treatments fail, surgery may be the next option. Procedures like arthroscopy (minimally invasive surgery) are sometimes covered, but insurance companies usually require evidence that other treatments haven’t worked first.

- Orthodontics: If your TMJ disorder is linked to bite problems, orthodontic treatment may be necessary. However, insurance rarely covers orthodontics unless there’s a clear link to your TMJ condition.

Challenges with TMJ Insurance Coverage (and How to Overcome Them)

Dealing with insurance can feel overwhelming, especially when trying to figure out if TMJ treatment is considered medical or dental. Here’s how to handle some common challenges:

- Medical vs. Dental Coverage: One of the biggest hurdles is figuring out if your TMJ treatment falls under medical or dental insurance. Treatments like physical therapy and medications typically fall under medical insurance, while appliances like night guards may be considered dental.

- Tip: Check both your medical and dental policies, or call your insurer to clarify.

- Pre-Authorization: For advanced treatments like surgery or injections, insurance companies often require pre-authorization. Failing to get this approval can leave you with a denied claim and a big bill.

- Tip: Always make sure your doctor submits the necessary paperwork and gets approval before starting any major treatment.

- Coverage for Oral Appliances: Many people find that night guards or splints aren’t fully covered by insurance, even though they’re essential for treating TMJ.

- Tip: If your doctor can show that the appliance is medically necessary, your insurance is more likely to cover it.

How to Get Your TMJ Treatment Covered by Insurance

Getting TMJ treatment covered by insurance doesn’t have to be a headache. Here are a few steps you can take to increase your chances:

- Get a Clear Diagnosis: A well-documented diagnosis from your doctor or dentist is crucial. Insurance companies are more likely to cover treatment if there’s clear evidence of a TMJ disorder.

- Know Your Policy: Understand the details of your medical and dental policies. What’s considered medically necessary? Are oral appliances covered? This knowledge will help you avoid surprises.

- Seek Pre-Authorization: For major treatments like surgery or injections, make sure your provider gets pre-authorization from your insurance. This step is essential to avoid denied claims.

- Keep Records: Document everything—from doctor’s visits to conversations with your insurance provider. These records can be invaluable if you need to appeal a decision or clarify coverage.

Conclusion

Dealing with TMJ can be challenging, but getting the right treatment shouldn’t add to your stress. By understanding your insurance coverage, you can take control of your health and avoid unnecessary expenses. Whether you’re considering physical therapy, medication, or surgery, make sure to check with your insurer about what’s covered. Armed with the right information, you can focus on feeling better and getting the relief you need.

Post Comment